T. S. Grewal Solution for Class 12 Commerce Accountancy Chapter 5 - Admission of a Partner Page/Excercise 2.92

Solution Ex. 53

Journal

| |||||

Sr. No.

|

Particulars

|

L.F.

|

Debit

Rs.

|

Credit

Rs.

| |

(a)

|

Provision for doubtful debts A/c

|

Dr.

|

5,000

| ||

----------To Revaluation A/c

|

5,000

| ||||

(Being provision on debtors reduced)

| |||||

(b)

|

Revaluation A/c

|

Dr.

|

5,000

| ||

----------To X's Capital A/c

|

3,000

| ||||

----------To Y's Capital A/c

|

2,000

| ||||

(Being profit on revaluation transferred to partners' capital A/c)

| |||||

T. S. Grewal Solution for Class 12 Commerce Accountancy Chapter 5 - Admission of a Partner Page/Excercise 4.111

Solution Ex. 97

Revaluation Account

| |||||

Dr.

|

Cr.

| ||||

Particulars

|

Rs.

|

Particulars

|

Rs.

| ||

To Bad Debts A/c

|

1,000

|

By Loss on Revaluation :

| |||

A's Capital A/c

|

750

| ||||

B's Capital A/c

|

250

|

1,000

| |||

1,000

|

1,000

| ||||

Partners' Capital Account

| |||||||

Dr.

|

Cr.

| ||||||

Particulars

|

A

|

B

|

C

|

Particulars

|

A

|

B

|

C

|

To Revaluation A/c

|

750

|

250

|

By Balance b/d

|

54,000

|

35,000

| ||

To Goodwill A/c

|

30,000

|

10,000

|

By Bank A/c

|

23,200

| |||

To Balance c/d

|

39,450

|

30,150

|

23,200

|

By Premium for Goodwill A/c

|

12,000

|

4,000

| |

By WCF A/c

|

3,000

|

1,000

| |||||

By IFF A/c

|

1,200

|

400

| |||||

70,200

|

40,400

|

23,200

|

70,200

|

40,400

|

23,200

| ||

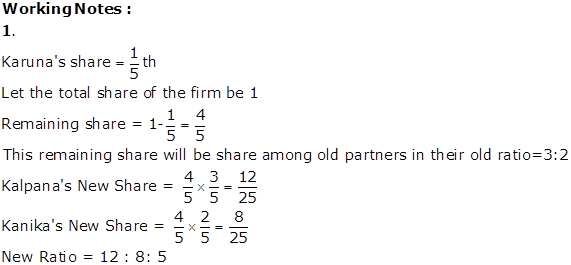

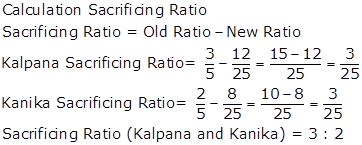

Working Notes:

1.

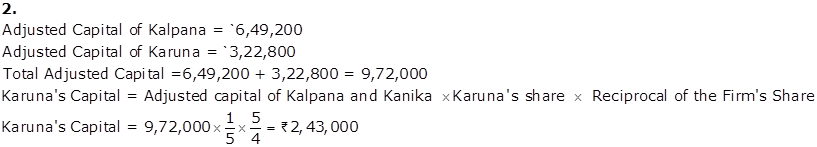

Calculation of C's Capital

A's Adjusted Capital = 54,000 + 12,000 + 3,000 + 1,200 - 750 - 30,000 = Rs.39,450

B's Adjusted Capital = 35,000 + 4,000 + 1,000 + 400 - 250 -10,000 = Rs.30,150

C's Capital = Total Adjusted Capital of A and B ×Reciprocal of Combined Profit Share × C's Profit Share

Notes:

- Premium for Goodwill Rs.16,000à Distributed between A and B in sacrificing ratio i.e. 3: 1.

- Excess WCF of Rs.4,000à Shared in old ratio among old partners.

- Excess IFF of Rs.1,600à Shared in old ratio among old partners.

T. S. Grewal Solution for Class 12 Commerce Accountancy Chapter 5 - Admission of a Partner Page/Excercise 4.113

Solution Ex. 101

Revaluation Account

| |||||

Dr.

|

Cr.

| ||||

Particulars

|

Rs.

|

Particulars

|

Rs.

| ||

To Revaluation Profit :

|

By Land and Building A/c

|

42,000

| |||

Kalpana's Capital A/c

|

61,200

|

By Plant A/c

|

60,000

| ||

Kanika's Capital A/c

|

40,800

|

1,02,000

| |||

1,02,000

|

1,02,000

| ||||

Partners' Capital Account

| |||||||

Dr.

|

Cr.

| ||||||

Particulars

|

Kalpana

|

Kanika

|

Karuna

|

Particulars

|

Kalpana

|

Kanika

|

Karuna

|

To Balance c/d

|

6,49,200

|

3,22,800

|

2,43,000

|

By Balance b/d

|

4,80,000

|

2,10,000

| |

By Cash A/c

|

2,43,000

| ||||||

By General Reserve A/c

|

36,000

|

24,000

| |||||

By W.C.F. A/c

|

24,000

|

16,000

| |||||

By Revaluation A/c

|

61,200

|

40,800

| |||||

By Premium for Goodwill A/c

|

48,000

|

32,000

| |||||

6,49,200

|

3,22,800

|

2,43,000

|

6,49,200

|

3,22,800

|

2,43,000

| ||

Balance Sheet

as on 1st April 2019 after Karuna's admission

| |||||||

Liabilities

|

Rs.

|

Assets

|

Rs.

| ||||

Creditors

|

90,000

|

Cash in Hand

|

4,53,000

| ||||

Capital

|

Debtors

|

1,32,000

| |||||

Kalpana

|

6,49,200

|

Less: Provision for debts

|

(12,000)

|

1,20,000

| |||

Kanika

|

3,22,800

|

Stock

|

2,10,000

| ||||

Karuna

|

2,43,000

|

12,15,000

|

Land and Building

|

2,52,000

| |||

Liability for Workmen Compensation

|

60,000

|

Plant

|

3,30,000

| ||||

13,65,000

|

13,65,000

| ||||||

T. S. Grewal Solution for Class 12 Commerce Accountancy Chapter 5 - Admission of a Partner Page/Excercise 5.100

Solution Ex. 74

No comments:

Post a Comment