economics

national income accounting solutions

NATIONAL INCOME ACCOUNTING

national income accounting solutions

NATIONAL INCOME ACCOUNTING

EXERCISE

QUESTION1: What are the four factors of

production and what are the remuneration to each of these called?

SOLUTION:

QUESTION 2:why should the aggregate final

expenditure of an economy be equal to the aggregate factor payment?

explain

SOLUTION:

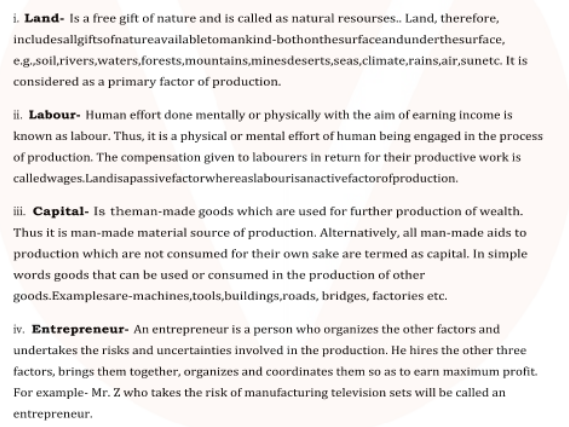

QUESTION3: distinguish between stock and flow

between net investment and capital which is a stock and which is a flow?

compare net investment and capital with flow of water into a tank

SOLUTION:

QUESTION4: what is the difference between

planned and unplanned inventory accumulation? write down the relation between

change the inventory And value added of the firm

SOLUTION:

QUESTION5: Write down the three identities of

calculating the gdp of a country by the three methods also briefy explain why

each of these should give us the same value of GDP

SOLUTION:

QUESTION6: define budget deflect and trade

effect the excess of private investment over saving of a country in a

particular year was rupees 2,000 crore the amount of budget defect was Rupees

1500 crores what was the value of rate defect of that country?

SOLUTION:

QUESTION7: suppose the GDP of market price

of a country in a particular year was rupees 1100 crore net factor income from

award was rupees hundred crore the value of indirect taxes subsidies was rupees

150 crore and national income was Rupees at 50 crore calculate the aggregate

value of depreciation

SOLUTION:

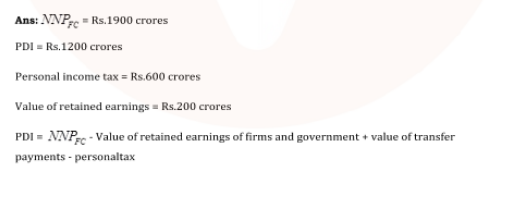

QUESTION8: net National Product at factor

cost of a particular country in a year is rupees 1900 crore there are no

interest payment made by household to the forms government for the forms

government to the household the personal disposable income of the household is

rupees 1200 crore the personal income taxes paid by them is rupees 600 borrowed

and the value of retained earning of the form and government is valued at 200

crores what is the value of transfer payment made by the government and form to

the households

SOLUTION:

QUESTION9: from the following data

calculate personal income and personal disposable income

NET DOMESTIC PRODUCT AT FACTOR COST 8000

NET FACTOR INCOME FROM ABROAD 200

UN DISBURSED PROFIT

1000

CORPORATE TAX

500

INTEREST RECEIVED BY HOUSEHOLD 1500

INTEREST PAID BY HOUSEHOLD 1200

TRANSFER INCOME

300

PERSONAL INCOME

500

SOLUTION:

QUESTION10: in a single day Raju the barber

collects rupees 500 from haircuts over this day his equipment appreciate in

value of rupees 50 of the remaining rupees 450 Raju pay sales tax both rupees

38 100 rupees 200 and retain 220 for improvement and buying new equipment if

father face rupees 20 as income tax for his income based on the information

calculate Raju contribution to the following measure of income Gross Domestic

Product NNP at market price NNP at factor cost personal income personal

disposable income

SOLUTION:

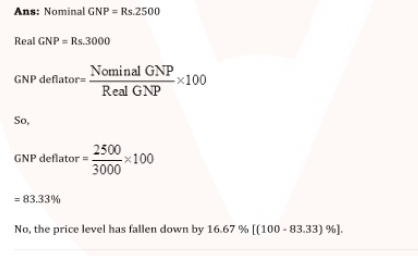

QUESTION11: the value of nominal gnp Open

Economy was rupees 2500 words in a particular area the value of GNP of that

country during the same year evaluated at the price of the same base year was

rupees 3000 crores calculate the value of GNP deflator of for the year in the

percentage terms has the price level risen between the base year and the year

under concentration

SOLUTION:

QUESTION12: write down some of the

limitation of using GDP as an index of welfare of a country

SOLUTION:

I HOPE THIS SOLUTIONS WILL HELP YOU A LOT

No comments:

Post a Comment